The Pulse of Private Equity – 12/10/2018

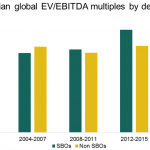

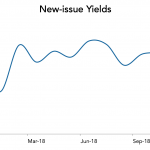

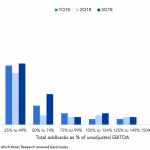

Why are SBOs more expensive? Download PitchBook’s Report here. Secondary buyouts have transacted at a premium versus non-SBOs since the financial crisis. That’s somewhat surprising; one might assume that “used” portfolio companies would trade at a discount given the operational improvements that have already been made, leaving less low-hanging fruit for the next sponsor. Not so…