TheLeadLeft

Select Deals in the Market – 11/19/2018

☞ Click for a larger image.

PDI Picks – 11/19/2018

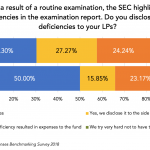

Opening the books to investors In a survey from sister publication pfm, the number of managers trying “very hard” not to disclose a deficiency uncovered via a routine exam by regulators increased by 7%. Perhaps the only thing worse than a realised credit loss for alternative lenders is when the Securities and Exchange Commission comes…

Leveraged Loan Insight & Analysis – 11/19/2018

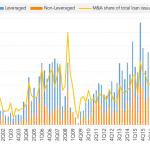

US M&A loan issuance continues at a healthy pace this quarter At around the halfway point in the quarter, US M&A activity has remained busy. Through November 14, there has been US$71bn in completed leveraged M&A issuance and US$10.6bn in completed non-leveraged M&A issuance…. Subscribe to Read MoreAlready a member? Log in here...

The Pulse of Private Equity – 11/19/2018

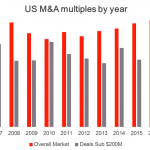

Is the middle market at an inflection point? Download PitchBook’s Report here. Much has been said on the consistent strength of the US middle market—much of it by us. Commenting as a data provider, we’ve found it tricky to creatively analyze the middle market without repeating ourselves. That said, there are a few unique ways to…

Debtwire Middle-Market – 11/19/2018

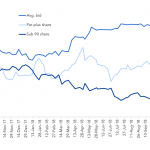

Oil & gas names drop on lower oil prices, secondary loan market softens Source: Debtwire Par, Markit Oil and gas loans have moved lower recently in tandem with the sharp decline in oil prices and the softening of the broader loan market. While the average bid on oil and gas term loans is up by…

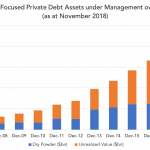

Private Debt Intelligence – 11/19/2018

Europe-Focused Private Debt Assets under Management Reach $200bn The European private debt universe has exploded over the last decade, and funds focused on the region now hold $200bn in assets under management. Europe has been a key area of interest for investors in private debt. In fact, almost half (47%) of private investors surveyed by…

Covenant Trends – 11/19/2018

Average Interest Coverage for Loan Deals Contact: Steven Miller

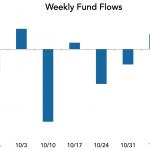

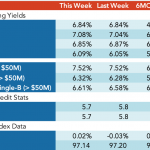

LevFin Insights: High-Yield Bond Statistics – 11/19/2018

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Loan Stats at a Glance – 11/19/2018

Contact: Marina Lukatsky marina.lukatsky@spglobal.com