Debtwire Middle-Market – 5/15/2017

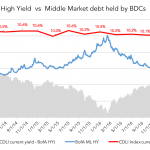

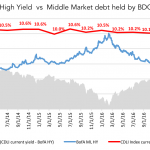

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield This month’s edition of the Debtwire Middle Market Junction podcast focuses on the mid-cap supermarket space following the recent bankruptcies of Central Grocers and Marsh Supermarkets. Topics covered include a behind the scenes look on what’s affecting smaller grocers, as well…