The Pulse of Private Equity – 8/7/2017

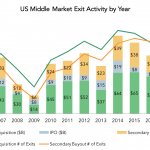

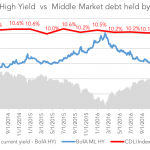

Middle Market Activity – 2Q Update, Part Two Download PitchBook’s 2Q 2017 US PE Middle Market Report click here. As we discussed last week, record-level fundraising is having an outsized effect on the PE middle market. So it comes as little surprise that secondary buyouts are taking a larger share of exit activity, with the…