The Pulse of Private Equity – 3/13/2017

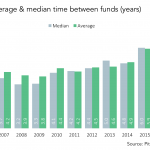

Longer fundraising times indicate future for PE fund managers?

The time between closing of funds was by far the longest of the decade for private equity fund managers last year, whether you looked at the median or the mean. Especially in the wake of the significant uptick in 2015 the increase is striking, and adds considerable color to the current fundraising scene. Firstly, in light of fund sizes creeping upward by and large, the simple fact that it takes longer to raise a larger fund should be noted...