The Pulse of Private Equity – 1/30/2017

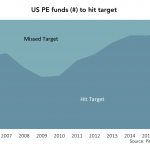

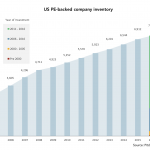

PE Fundraisers As Successful as Ever, Suggesting Industry’s Maturation

89% of private equity funds closed in the US last year, against a backdrop of healthy fundraising levels—252 vehicles combined for a total of $180 billion committed. This decade-high proportion of fundraising success leads one to the most evident conclusion that limited partners are still eager for exposure to the asset class. Combined with the historically strong median buyout fund size of $250 million in 2016...