The Pulse of Private Equity – 12/5/2016

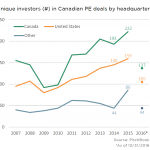

US PE firms dial down their pace of investing in Canadian startups

In 2015, no fewer than 159 private equity firms with headquarters in the US cut a deal with a Canadian company, a clear high for the decade. That pace has slowed considerably even as general Canadian PE activity has declined, with 105 firms active within the country through the end of October. The drivers of the decline are likely the same as in the US: a lack of quality targets given the surge in buying over the last couple of years, competition, and a surplus of dry powder contributing to loftier prices...