TheLeadLeft

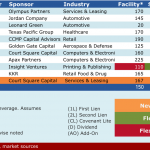

Select Deals in the Market – 10/31/2016

☞ Click for a larger image.

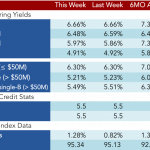

Loan Stats at a Glance – 10/31/2016

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

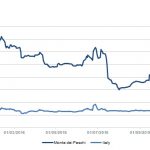

Markit Recap – 10/24/2016

Credit investors, whether in cash or synthetics, often welcome corporate restructurings by distressed firms. Job cuts, rationalisation of operations and, in particular, asset sales are usually regarded as bondholder friendly actions.

But this 'wasnt the reaction when Banca Monte dei Paschi di Siena (MPS) announced plans to restructure its ailing business. The Italian bank said that it would reduce jobs by 2,500 – cutting 10% of its staff costs - and close 500 of its 2,000 branches over the next three years. MPS also declared that it would sell its payments processing unit for €520 million...

Leveraged Loan Insight & Analysis -10/24/2016

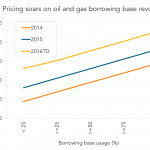

Pricing soars on oil and gas borrowing base revolvers

After collapsing to a 10-year low of less than $30 in January, oil prices are now in the $50 per barrel range. While prices might have stabilized, the industry continues to suffer severe consequences. Defaults have escalated and recovery rates are down significantly from their historical levels. According to Moody's, loans that are backed by reserves for exploration and production companies have fared better than other debt types...

Covenant Trends – 10/24/2016

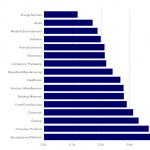

Industry Average (YTD): Free & Clear Incremental Tranche / EBITDA Contact: Steven Miller smiller@covenantreview.com

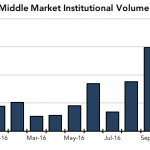

Chart of the Week: Fall Rising

So far in October, middle market loan activity is tracking for its fourth consecutive month-over-month improvement.

The Art of the Add-On (First of a Series)

“It’s been a relatively slow year for us,” one managing partner related to us recently. His middle market private equity firm had just completed a successful fundraise, but was finding investing opportunities scarcer than last year. “We’ve only completed four new platform buyouts.” Then he smiled. “But we have done eighty-seven add-ons.” The prevalence of…

Lead Left Interview – Tod Trabocco

This week we chat with Tod Trabocco, Managing Director at Cambridge Associates LLC. Cambridge is a leading investment advisor to foundations, endowments, private wealth, and corporations worldwide. The Lead Left: For Lead Left readers who may not know Cambridge Associates, could you give a brief introduction of the firm and your role in it? Tod…

The Pulse of Private Equity – 10/24/2016

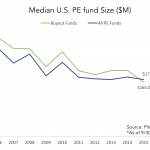

PE Fundraisers Going Bigger in 2016 Portends Emerging Spread in Success?

At $225 million, the median US private equity fund size is higher thus far in 2016 than in the several years prior. This is despite relatively healthy fundraising activity in general, with 57 closed vehicles in the third quarter alone; one may suppose that diminished activity could artificially inflate median fund sizes, as the most successful firms are still able to close while others miss out, but that is not the case this year. The increase in size is attributable to a confluence of factors...