Leveraged Loan Insight & Analysis -10/10/2016

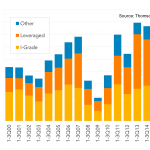

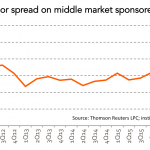

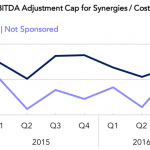

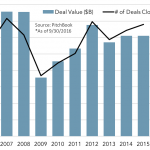

3Q16 Loan volume down nearly 40% q-o-q, 1-3Q16 totals down 11% y-o-y Issuance in the US loan market got off to a rough start in 3Q16 to dampen results for the full quarter while leaving lenders and investors hungry. At US$372 billion,… Subscribe to Read MoreAlready a member? Log in here...