TheLeadLeft

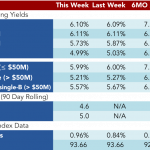

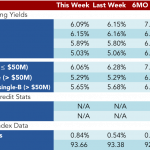

Loan Stats at a Glance – 10/3/2016

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

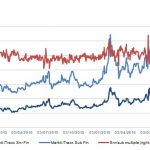

Markit Recap – 9/26/2016

We noted last week that Deutsche Bank could soon become the widest name in the Markit iTraxx Europe if its credit deterioration continued. It came to pass perhaps sooner than many expected, with its senior five-year spreads closing at 251bps on September 26, 6bps wider than Glencore. This is a significant development, and reflects the…

Leveraged Loan Insight & Analysis -9/26/2016

The secondary market has continued to climb as the combined impact of robust demand for paper and the lack of sufficient net new deal flow puts upward pressure on loan bids. Steady CLO issuance and money entering retail funds have provided the impetus on the demand side. Month to date CLO issuance is at $7.1…

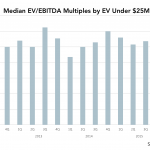

The Pulse of Private Equity – 9/26/2016

Median EV/EBITDA buyout multiples surge in 2Q 2016 for sub-$25M enterprises Respondents to PitchBook’s most recent Deal Multiples survey reported a median EV-to-EBITDA multiple of 6.13x at the sub-$25 million EV range in 2Q 2016. That figure is nearly a turn higher than what was recorded in the first quarter of the year. One of…

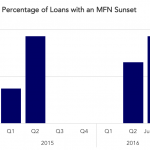

Covenant Trends: Percentage of Loans with an MFN Sunset

Contact: Steven Miller smiller@covenantreview.com

Lead Left Interview – Fran Beyers

This week we chat with Fran Beyers, Senior Market Analyst at Thomson Reuters LPC. Thomson Reuters LPC has been a leading provider of loan market news, data and analysis for over 30 years. Fran has been with LPC since 2009 providing analysis and market commentary on the middle market. The Lead Left: Fran, you’ve recently…

Loan Stats at a Glance – 9/26/2016

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

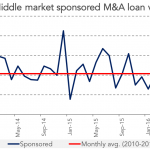

Chart of the Week: Higher Ground

Monthly loan activity related to middle market buyouts has risen above the five year average for the first time in a year. Source: Thomson Reuters LPC