Markit Recap – 7/4/2016

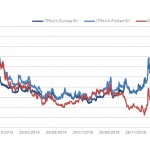

The parlous condition of the European banking system keeps coming back to haunt the global economy, with the latest attack of lurgy coming from Brexit. The UK electorate’s vote to leave the EU has laid bare the weak credit quality of lenders, a state of affairs that needed little revealing. Markit’s iTraxx Senior Financials index,…