The Pulse of Private Equity – 7/11/2016

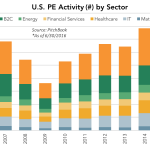

IT Remains a Favorite of PE Firms As private equity activity in the U.S. has slackened, nearly every sector has experienced a decline in overall volume of investments, barring one. Only the information technology sector is seeing a rate of PE dealmaking comparable to that of last year, with 261 closed transactions through the end…