Preqin Private Debt Intelligence – 5/30/2016

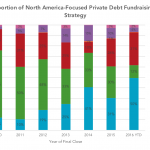

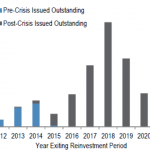

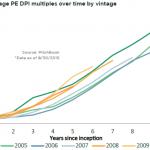

Distressed Debt Fundraising Overtaken by Direct Lending in North America During the Global Financial Crisis (GFC), the distressed debt market in North America established itself as the driving force behind the emerging industry of private debt in the region. Throughout 2007 and 2008, an aggregate $80bn was raised through distressed debt vehicles as investors allocated…