Markit Recap – 4/18/2016

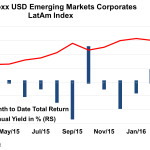

Brazil leads as credit risk in Latam region recedes Brazil’s 5-yr sovereign CDS spread has tightened to its lowest level since last August Peru, Chile and Colombia have all seen a 35% tightening in sovereign credit spreads Markit iBoxx USD Emerging Markets Corporates LatAm Index has returned 7.7% this year Credit markets reacted positively after…