Back to School (Part Two)

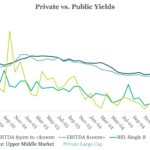

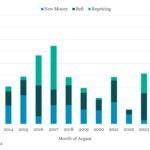

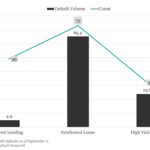

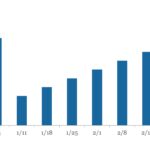

Post-Labor Day market conditions continue to favor credit issuance of all stripes. Rather than being hampered by uncertainty surrounding tariffs, inflation, growth or rates, borrowers and investors have decided these dynamics have been settled in favor of “risk on!” What then are the real worries for credit? While lower rates and less chance of a…