Leveraged Loan Insight & Analysis – 3/7/2016

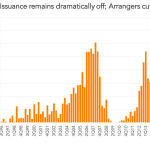

Just shy of three months into 2016, CLO issuance remains stalled, logging less than US$3 billion in new vehicles through the end of February. This represents an 80% drop compared to the same time last year. More notably, only a few days into March, a single CLO has come to market via a US$406.75 million…