TheLeadLeft

Loan Stats at a Glance – 9/14/2015

Contact: Daniel Mena daniel.mena@spcapitaliq.com

Markit Recap – 9/7/2015

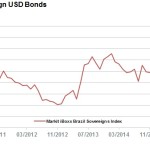

Brazilian bonds sink prior to downgrade Brazil’s recent downgrade to junk will come as little surprise to market observers given the increasingly bearish sentiment seen in Brazilian sovereign bonds. Brazilian CDS spreads at 371bps, twice where they stood a year ago… Subscribe to Read MoreAlready a member? Log in here...

Why Volatility Matters (Part One)

According to Merriam-Webster, the word “volatility” comes from the Latin, volātilis, meaning flying. Any investor who has remotely been paying attention to market events over the past several weeks can appreciate that etymological derivation. Even this community grown accustomed to wild swings of value over the past seven years was taken aback by the gyrations…

Lead Left Interview – Wayne McKinzie

This week we chat with Wayne McKinzie, a partner at Moore & Van Allen PLLC. Named in Best Lawyers in America for Banking and Finance Law, Wayne represents investors in various senior and mezzanine financing transactions and investments. Moore & Van Allen, based in Charlotte, is one of the largest law firms in the Southeast,…

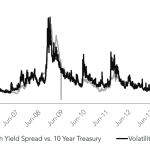

Chart of the Week – Correlation Nation

The high yield bond premium over Treasuries and volatility as measured by the VIX have proven to be highly correlated. Source: Bloomberg

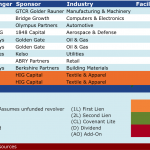

Leveraged Loan Insight & Analysis – 9/7/2015

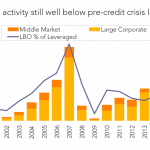

M&A activity in the syndicated loan market is as strong as ever, however the volume is simply not coming from buyout deals. Private equity shops continue to struggle with winning and making buyout deals work given lofty valuations and extreme competition. Completed LBO… Subscribe to Read MoreAlready a member? Log in here...

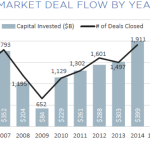

The Pulse of Private Equity – 9/7/2015

Opportunity Ahead for PE? The finance community has been hit hard the past few weeks. Even long-term asset classes like venture are keeping tabs on short-term fluctuations in the market. Private equity doesn’t seem as concerned, and shouldn’t be. The biblical seller’s market that began in… Subscribe to Read MoreAlready a member? Log in here...