TheLeadLeft

Loan Stats at a Glance – 10/5/2015

Contact: Daniel Mena daniel.mena@spcapitaliq.com

Markit Recap – 9/28/2015

In recent years, the credit markets have become accustomed to volatility, despite the best efforts of central banks to tame the beast. But where it was sovereigns and banks that were the instigators during the crises of 2007-2012, in 2015 it is the commodities sector that is providing the oscillations. Nowhere was this more evident…

Why Volatility Matters (Last of a Series)

With the passing of Yogi Berra, the position of sports legend/philosopher is now vacant. While no obvious candidates have stepped forward, we offer to nominate Cam Newton, star quarterback of the Carolina Panthers. Second-guessed on a play call by a reporter at a press conference last October, he replied with a shrug, “Hindsight is always…

Lead Left Interview – Tim Hopper (Part 2)

This week we continue our conversation with Tim Hopper, managing director and chief economist for TIAA-CREF. Tim has over 20 years of experience writing and speaking about the global economy. Prior to joining TIAA-CREF, Mr. Hopper held various leadership positions in global banking and real estate. He also served as a senior economist with the Federal…

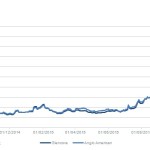

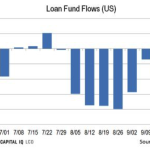

Chart of the Week – Retail Outlet

Cash leaving loan funds has slowed, but still sees nine consecutive weeks of $4 billion outflows.

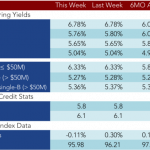

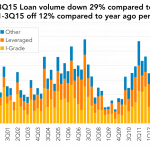

Leveraged Loan Insight & Analysis – 9/28/2015

Volatility returned to the loan market in 3Q15 to contribute to a deeper and more sustained summer slowdown which saw just over $401billion of issuance work its way through syndication. This marked a decline of nearly 29 percent compared to 2Q15 figures and an 11 percent drop compared to the year ago period. Similarly, at less than $1.4…

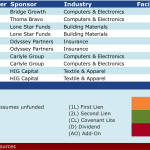

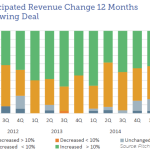

The Pulse of Private Equity – 9/28/2015

Overall Optimistic, Investors See Choppiness Ahead Private equity firms typically target companies that are in trouble. It’s the heart of the traditional buyout model, which, although shifting as the industry matures, remains the core of PE dealmaking. However, the relative health of target companies can shift considerably depending on overall deal trends—nowadays is no exception….