TheLeadLeft

Loan Stats at a Glance – 9/28/2015

Contact: Daniel Mena daniel.mena@spcapitaliq.com

Markit Recap – 9/21/2015

German corporate credit, generally regarded as a safe bet, has had a torrid time of late. Last week we looked at how the costs of transitioning from nuclear to clean energy had inflicted damage on German utilities and sent credit spreads spiralling wider. This week it was the turn of the auto industry, and Germany’s…

Lead Left Interview – Tim Hopper

This week we chat with Tim Hopper, managing director and chief economist for TIAA-CREF. Tim has over 20 years of experience writing and speaking about the global economy. Prior to joining TIAA-CREF, Mr. Hopper held various leadership positions in global banking and real estate. He also served as a senior economist with the Federal Reserve…

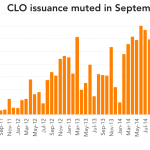

Leveraged Loan Insight & Analysis – 9/21/2015

After a busy first half of the year, CLO issuance has been relatively muted in the 3rd quarter, recording $15.5 billion of new CLO paper so far, that is, half the volume recorded in each of the first 2 quarters of the year. Year-to-date volume stands at $76 billion, down from the $94 billion recorded at the…

Why Volatility Matters (Third of a Series)

In the classic 1962 film, “Lawrence of Arabia,” two British officers watch the unfolding chaos as Arab tribes vie for control of Damascus. Eager to keep events from spiraling out of control, the colonel pleads with his commanding officer, “We can’t just do nothing.” The general, savvy to the political reality, replies calmly, “Why not?…

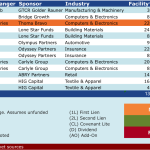

The Pulse of Private Equity – 9/21/2015

With High Valuations Persisting, PE Buyers Still Cautious PE dealmakers are still grappling with increased regulatory scrutiny and stubbornly persistent high valuations. The chance to ameliorate price pressures still remains, with lending markets left wide open by ongoing competition… Subscribe to Read MoreAlready a member? Log in here...

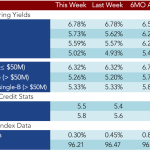

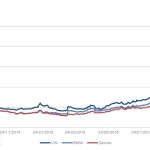

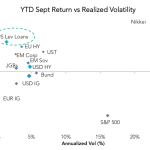

Chart of the Week – Best in Class

So far this year leveraged loans have managed to earn a 3% return – better than other investments, and with lower volatility. Source: Credit Suisse