Leveraged Loan Insight & Analysis – 7/20/2015

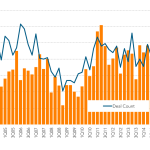

2Q15 ABL volume at lowest level in nearly 2 years; 1H15 total down 17% y-o-y ABL volume tumbled in 2Q15 to close out the period at just over $18 billion, the lowest quarterly volume results since 3Q13. 1H15 issuance settled at $38.5 billion, a drop of nearly 17% compared to the year ago period…. Subscribe