TheLeadLeft

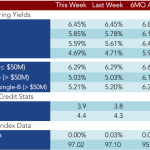

Loan Stats at a Glance – 7/6/2015

Contact: Cuong Huynh cuong.huynh@spcapitaliq.com

Markit Recap – 6/29/2015

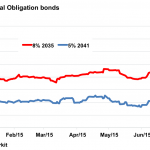

Puerto Rico credit risks largely isolated Puerto Rico’s unsustainable debt problems have intensified this week, but the wider municipal bond market has so far remained resilient. Puerto Rico’s 2035 general obligation bond has seen its price drop from 77 on Friday June 26th to 66.2 on June 30th… Subscribe to Read MoreAlready a member? Log

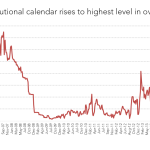

Chart of the Week – Follow the Flows

Not surprisingly, investors’ views of where interest rates will go track investing decisions on floating rate instruments. Source: Wells Fargo, Desktop Q3 2015 CLO Outlook.

Greek Week

A banker friend vacationing in Greece this week reports asking a fifty-something customer in an Athens coffee shop what he did for a living. The man responds he’s been unemployed for the last four years. “The Greeks invented everything,” he said, “and now I’m taking a rest.” Certainly seems like déjà EU all over again:…

Lead Left Interview – Scott Kupor

This week we chat with Scott Kupor, managing partner and COO, Andreessen Horowitz. Andreessen Horowitz is a $4 billion venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz. The company is headquartered in Menlo Park, California. The Lead Left: Scott, thanks for taking the time to speak with us. How did the…

The Pulse of Private Equity – 6/29/2015

Multiples are having an impact, and that’s a good thing Global private equity activity was down in H1, by several metrics. Compared to H1 2014, deal flow declined 16% by count and 21% by total value, to 2,728 deals worth $404.7 billion. Last year’s numbers were 3,265 deals worth a combined $514.7 billion…. Subscribe to Read

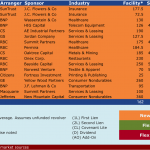

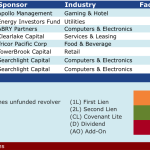

Leveraged Loan Insight & Analysis – 6/29/2015

The institutional pipeline has ballooned in recent weeks on the back of several sizeable M&A deals. Last week, the calendar reached almost $80 billion, which is the highest level since February 2013. The driver of the jump is mostly two jumbo sized M&A deals for Charter… Subscribe to Read MoreAlready a member? Log in here...