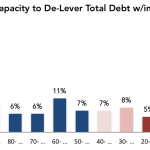

Chart of the Week – Payback Time

Regulators cite “weak characteristic” of many leveraged borrowers’ inability to repay debt within seven year tenors. Source: The Fed, FDIC, OCC (Shared National Credits Program (2014 Leveraged Loan Supplement)… Subscribe to Read MoreAlready a member? Log in here...