Leveraged Loan Insight & Analysis – 12/1/2014

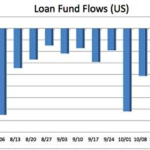

Following a spike in volatility in October, investors remained cautious in November. Stronger credits caught investors’ attention and issuers were able to lower costs during syndication, but… Subscribe to Read MoreAlready a member? Log in here...