Chart of the Week – 7/7/2014

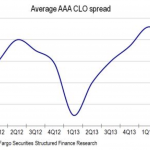

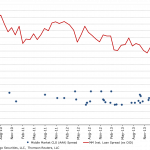

Treble Ahead New providers of triple-A CLO liabilities are expected to help tighten spreads to 135-140 bps by year-end. Beyond that, uncertainty on vehicle structures could reverse that trend…. Subscribe to Read MoreAlready a member? Log in here...