TheLeadLeft

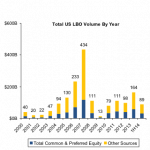

Chart of the Week – 7/28/2014

Not For Sale Leveraged buyout activity since the credit crisis has been muted, though 2014 volume could be best since 2006…. Subscribe to Read MoreAlready a member? Log in here...

Lead Left Interview – Michael J. Hall (Part Two)

This week we continue our conversation with Michael J. Hall, managing partner at Yukon Capital Partners. Yukon provides mezzanine capital to middle market businesses with a focus on deals controlled by private equity sponsors. Second of two parts – View part one The Lead Left: How did equity co-investments get started? Michael J. Hall: It wasn’t always a feature,…

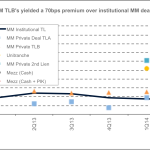

Leveraged Loan Insight & Analysis – 7/28/2014

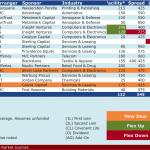

The middle market is quite a diverse market place and yields vary based on lender type and EBITDA size. In 2Q14, moving down market to lend TLBs to smaller private middle market issuers resulted in a nice 70bps premium for first lien deals over rated, public middle market institutional deals. However, while there is a premium…

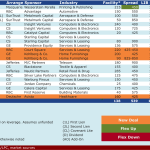

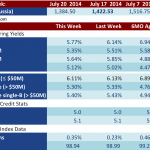

Loan Stats at a Glance – 7/28/2014

Source: S&P Capital IQ Contact: Robert Polenberg robert.polenberg@spcapitaliq.com

Leveraged Loan Insight & Analysis – 7/21/2014

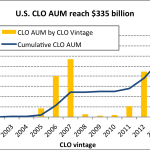

Cumulative CLO assets under management (AUM) increased to $335 billion in July with CLO AUM reaching $65 billion for CLOs with 2014 vintage. This figure is quickly catching up to the $81 billion in assets under management for 2013 vintage… Subscribe to Read MoreAlready a member? Log in here...

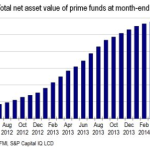

Chart of the Week – 7/21/2014

Prime Targets Retail loan funds have suffered outflows 14 of the past 16 weeks, shrinking net additions to $765 million so far this year, compared to $30 billion for the same period last year…. Subscribe to Read MoreAlready a member? Log in here...

Markit Recap – 7/21/2014

European banks are no strangers to unpleasant shocks. The latest came from Portugal, where Banco Espirito Santo (BES) came under pressure following news that the Espirito Santo holding company – BES’s largest shareholder – had run into financial difficulties…. Subscribe to Read MoreAlready a member? Log in here...

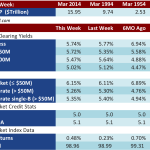

Loan Stats at a Glance – 7/21/2014

Source: S&P Capital IQ Contact: Robert Polenberg robert.polenberg@spcapitaliq.com