Leveraged Loan Insight & Analysis – 8/11/2025

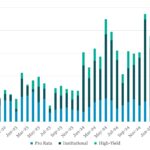

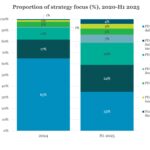

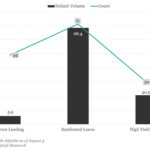

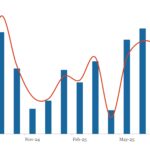

LevFin books new issuance record in July thanks to loan repricings, while growing M&A business shouldn’t be overlooked US leveraged finance issuance topped US$236bn in July, eking a new all-time monthly high for the business…. Subscribe to Read MoreAlready a member? Log in here...