Debtwire Middle-Market – 5/2/2022

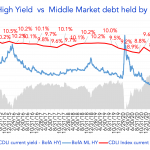

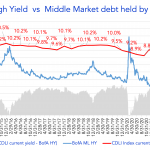

High Yield bond secondary prices tumble, sending yields to post-pandemic highs Source: BofA US HY Index, Debtwire Par Average prices for high yield bonds trading in the secondary market have taken a significant hit this year, falling from a high of 103.17 in January to just 92.31 on 4 May, according to the ICE BofA…