Debtwire Middle-Market – 9/20/2021

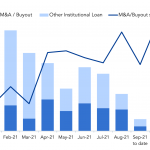

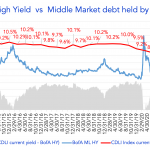

M&A/Buyout deals outnumber refinancings, sending pricing higher Source: Dealogic, Debtwire Par With institutional issuance slowing to USD 43.6bn in August, its lowest level in the year to date (YTD), a steady flow of M&A and buyout related financings (USD 25.2bn or 58% of monthly issuance) and a slowdown in refinancing transactions (USD 12.2bn or 28% of issuance) contributed…