Debtwire Middle-Market – 2/8/2021

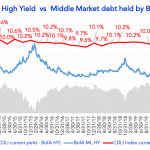

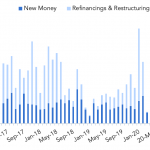

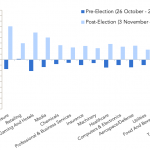

Convergence of market dynamics brings loans back into focus Source: Debtwire Par The convergence of several market factors has led loans to the forefront of the leveraged debt markets in 2021. Institutional loans made up roughly two thirds of combined loan and bond issuance in January, one of the highest proportions seen since this time…