Debtwire Middle-Market – 3/25/2019

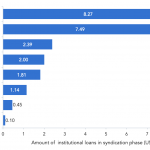

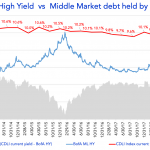

Leveraged loan buyers book healthy gains as secondary market shifts higher in 1Q19 Source: Debtwire Par, Markit The latter part of 2018 proved to be an attractive buying opportunity for those willing and able to pick up loan assets in the secondary market. Since then, prices have shifted noticeably higher…. Subscribe to Read MoreAlready a