Leveraged Loan Insight & Analysis – 10/7/2019

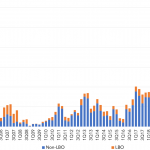

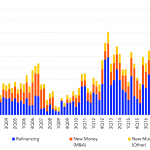

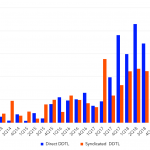

1-3Q19 Sponsored loan volume off 48%; LBO volume at 3-year low Less than US$90bn in syndicated loan volume backing PE sponsor activity was completed in the US market in 3Q19, the third lowest quarterly total in the last three years, and a 30% drop year over year. In turn, less than US$265bn in sponsored loan…