Leveraged Loan Insight & Analysis – 2/11/2019

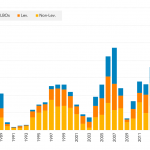

Global green loan volume nearly US$6bn one month into 2019 Barely five weeks into the new year, nearly US$6bn in green and ESG loan financings have worked their way through the global market. At first glance it may not seem impressive given the nearly US$9.5bn that was raised the same time last year, but green…