Leveraged Loan Insight & Analysis – 11/19/2018

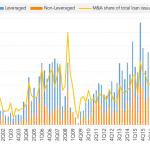

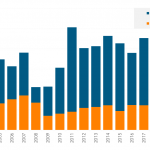

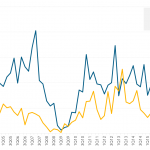

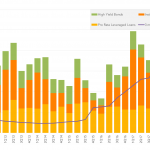

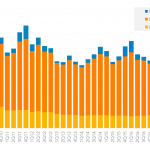

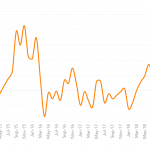

US M&A loan issuance continues at a healthy pace this quarter At around the halfway point in the quarter, US M&A activity has remained busy. Through November 14, there has been US$71bn in completed leveraged M&A issuance and US$10.6bn in completed non-leveraged M&A issuance…. Subscribe to Read MoreAlready a member? Log in here...