Leveraged Loan Insight & Analysis – 12/7/2015

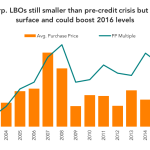

The average purchase price for large corporate LBO deals is still well below the large-scale deals struck during the buyout boom, but select mega deals are resurfacing. The average purchase price year to date for large corporate LBO deals is around $1.8 billion, slightly behind 2014 levels of $1.9 billion, but far lower… Subscribe to