Leveraged Loan Insight & Analysis – 11/18/2024

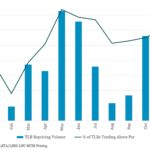

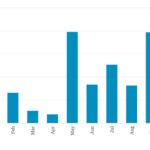

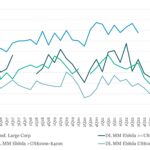

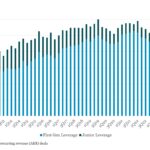

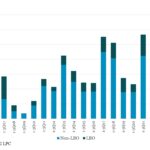

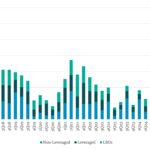

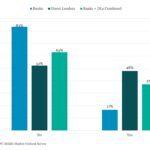

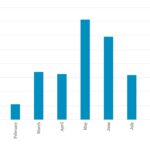

A flurry of new leveraged loans hit the market post elections and in run up to year end After a brief pullback in the institutional calendar in the week leading up to the US election, lenders have tapped the market with a flurry of deals…. Subscribe to Read MoreAlready a member? Log in here...