The Pulse of Private Equity – 6/26/2023

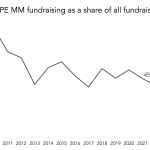

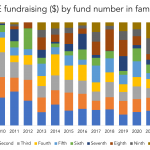

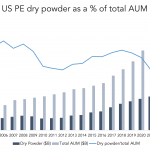

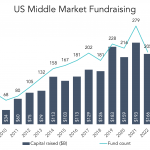

MM fundraising is having its moment Download PitchBook’s Report here. Middle-market fundraising is having a moment in the sun. PitchBook’s latest US PE Middle Market Report recorded $49.9 billion raised in MM strategies in Q1, up 70% from Q1 2022. A historical look at fundraising seasonality bodes well for the middle market. Over the past decade,…