The Pulse of Private Equity – 4/10/2023

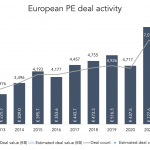

Q1: A mixed verdict Download PitchBook’s Report here. 2023 started with mixed results. According to PitchBook’s just-released Q1 2023 US PE Breakdown, deal flow slid 9% while deal value rose about 11%. Both figures are ahead of pre-Covid levels, but post-Covid trends continue to decline…. Subscribe to Read MoreAlready a member? Log in here...