The Pulse of Private Equity – 5/2/2022

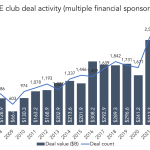

PE firms are clubbing again Download PitchBook’s Report here. During the buyout boom of 2005-2008, “club” deals were a common sight, especially at the high end. When the music stopped in 2008, many of the biggest portfolio companies were held by three or more PE firms, who had to make “club” decisions about what to do…