The Pulse of Private Equity – 11/22/2021

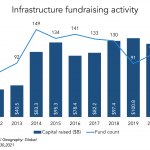

Is infrastructure poised for a resurgence? Download PitchBook’s Report here. Infrastructure is much in the news these days, given the massive spending bill currently being legislated in the US government, as well as even more earmarks being discussed worldwide by other nations. The potential implications of such significant investment in infrastructure, particularly in digital and energy,…