The Pulse of Private Equity – 7/22/2019

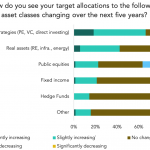

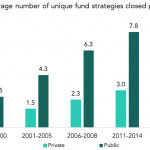

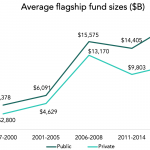

Private markets grow in size, importance Private market strategies are growing and will continue to grow for the foreseeable future. PitchBook heard from 101 institutional limited partners as part of a new survey report (Private Markets: A Decade of Growth) to see where LPs are allocating their money in the near-term. Two-thirds said they’d be…