The Pulse of Private Equity – 1/22/2018

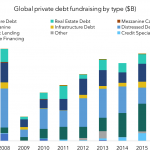

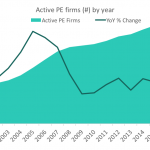

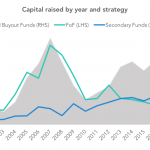

A once-in-a-decade fundraising market Download PitchBook’s Report click here. Private equity is a scalable asset class. The same isn’t true for every asset class in the private market – venture funds, for example, tend to lose effectiveness if they grow too large, regardless of sector. Not so with PE, which broadens its target range with…