The Pulse of Private Equity – 4/10/2017

Is the PE industry on pace for lower net cash flows?

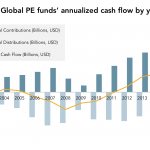

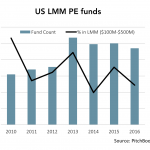

Since 2012, net cash flows of private equity funds worldwide have been positive, with the last three full years handily exceeding $130 billion apiece. With fund returns through the middle of 2016, however, net cash flows currently stand at $27.0 billion, putting the back half of 2016 under considerable stress to even leave the year at more than $100 billion. This diminishing metric is attributable to a variety of factors, including the slow winding down of the buyout cycle in addition to a sluggish exit market...