The Pulse of Private Equity – 11/7/2016

PE buyers still rooting for value in lower reaches of US middle market

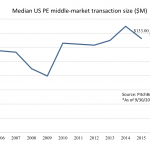

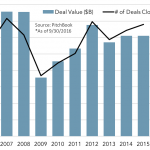

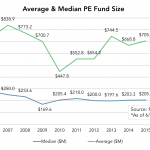

The proliferation of private equity funds into all reaches of the US middle market has been well documented. Increased PE activity in the lower and core segments of the middle market is easy to see, particularly when assessing the median transaction size, which declined from a high in 2014 to $133.0 million last year and $128.6 million through the end of September. The slides aren’t dramatic, of course, but as can also be seen in the relatively more resilient proportions of PE dealmaking within the lower middle market...