The Pulse of Private Equity – 5/16/2016

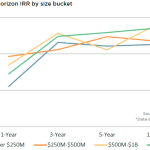

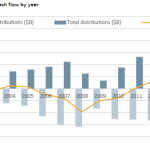

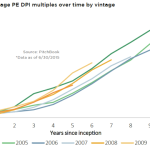

Larger PE Funds Continue to Realize Gains at Longer Horizons From the one-year mark to the 10-year, the horizon internal rates of return (IRRs) of private equity funds worldwide gradually advance from 8.2% to 13.1%. Breaking down fund performance by size bucket yields further insights, most notably that on a sufficiently long time horizon, funds…