The Pulse of Private Equity – 3/7/2016

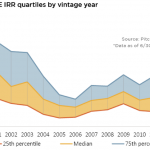

How Will Competition Among Fund Managers Affect Future Industry Performance Disparity? Post-recession private equity funds experienced a tightening of IRR spreads across several different vintages, as fund managers of all tiers weathered the economic downturn. 2010 and more recent vintages, however, have seen a widening of the spread…. Subscribe to Read MoreAlready a member? Log