The Pulse of Private Equity – 2/16/2015

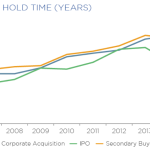

Hold times are leveling out Hold times for PE portfolio companies have been steadily creeping upward since about 2009, peaking around five and a half to six year medians…. Subscribe to Read MoreAlready a member? Log in here...