The Pulse of Private Equity – 12/1/2014

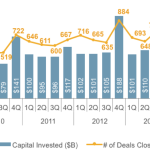

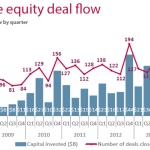

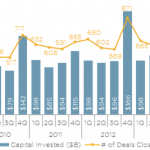

A Soft Fourth Quarter This Year We’ve heard from some industry professionals that fourth quarter deal flow is probably going to be softer than normal this year. The first two months of 4Q 2014 have seen 440 PE deals close in the U.S. worth a combined $90.9 billion…. Subscribe to Read MoreAlready a member? Log