The Pulse of Private Equity – 3/18/2024

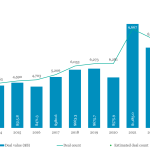

Median PE middle-market EV/EBITDA multiples Download PitchBook’s Report here. Both EV/EBITDA and EV/revenue multiples tell a similar story for middle markets: Valuations reached their apex in 2021 and have declined sharply ever since. Middle-market PE deal multiples are now down 25.0% to 40.6% from their peak, and unlike the overall M&A market, there are no signs…