The Pulse of Private Equity – 12/18/2023

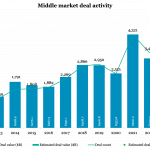

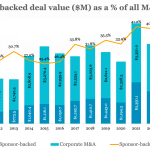

Middle-market activity: A 6-year low Download PitchBook’s Report here. Middle market buyouts are down to a six-year low, according to PitchBook’s Q3 US PE Middle Market Report. The third quarter dipped to an estimated $87.7 billion, a 13% decline from Q2 2023 and a 48% decline from the peak in Q4 2021…. Subscribe to Read MoreAlready