PDI Picks – 1/23/2023

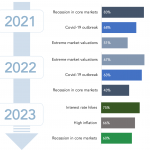

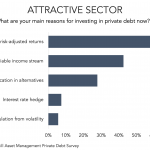

Rates become chief performance concern Inflation and interest rates enter investors’ list of top three worries this year, as fears of a recession persist. Rising interest rates and inflation have become the key concerns for investors taking part in Private Debt Investor’s LP Perspectives 2023 Study, for the first time pushing extreme market valuations out…